You know that feeling when you check your fitness app after a busy month and see you’ve barely hit 5,000 steps a day? Or when you realize you haven’t called your best friend in three weeks because work has been consuming everything? The immediate response is often shame, followed by a frantic attempt to “fix” everything at once.

We’ve been taught to think of life like a single scoreboard where we’re either winning or losing across all areas simultaneously. Miss a workout? You’re failing at health. Skip a work networking event to attend your kid’s recital? You’re not committed to your career. Don’t meal prep on Sunday? You’re disorganized and behind.

This single-scoreboard mentality isn’t just exhausting—it’s setting us up for a kind of brittleness that makes normal human seasons feel like personal failures.

The Fragility of One-Metric Living

When everything rides on one scoreboard, any dip feels catastrophic. You’re either “on track” or you’re not. There’s no nuance, no seasons, no acknowledgment that attention is finite and life comes in waves.

I’ve watched friends completely abandon exercise routines because they missed a week during a work crisis. The all-or-nothing thinking kicked in: if they couldn’t maintain their streak, why bother at all? They treated a temporary shift in focus like a complete system failure.

The single-scoreboard approach also creates this weird competitive dynamic with yourself across time. You measure today’s energy against your peak performance from six months ago, forgetting that six months ago you weren’t managing a sick parent, a job transition, or a toddler who stopped sleeping through the night.

But what if we borrowed a concept from finance and started thinking about life as a portfolio instead?

The Portfolio Approach to Being Human

In investing, a portfolio spreads risk across different assets. When tech stocks are down, maybe bonds are stable. When one sector struggles, another might be thriving. The goal isn’t for every investment to perform perfectly all the time—it’s for the overall portfolio to remain healthy and aligned with your values over the long term.

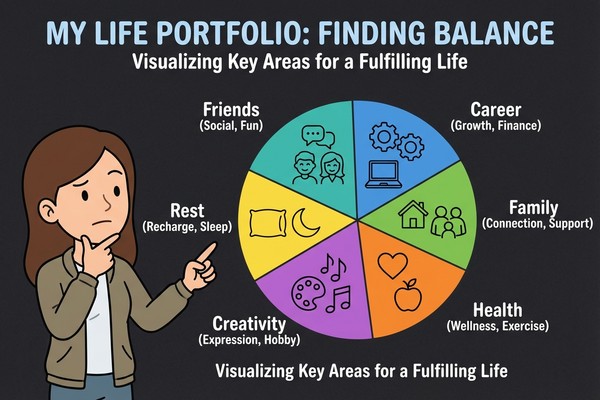

Your life can work the same way. Instead of one scoreboard measuring your worth, you have multiple areas of investment: relationships, health, creativity, career, rest, learning, community. Sometimes you’re heavily invested in one area because that’s what the season requires. Sometimes you need to rebalance.

The portfolio mindset acknowledges something the single-scoreboard approach refuses to admit: you cannot optimize everything simultaneously. Attention is finite. Energy has limits. And that’s not a personal failing—it’s physics.

You cannot optimize everything simultaneously. Attention is finite. Energy has limits. And that’s not a personal failing—it’s physics.

When my friend Sarah had her second baby, her career portfolio allocation shifted dramatically. She wasn’t “falling behind” in her professional life—she was making a conscious, temporary reallocation of resources toward family. Her portfolio was still balanced; it just looked different than it had six months earlier.

This reframe changes everything about how we interpret our own behavior and set expectations.

Recognizing When You’re Over-Invested

In financial portfolios, over-investing in one area creates vulnerability. Put everything in tech stocks, and you’re exposed when that sector crashes. The same thing happens in life portfolios.

Over-investment in work might look like checking emails during your kid’s bedtime story, or realizing you can’t remember the last conversation you had with your partner that wasn’t about logistics. Over-investment in fitness might mean you’re irritable and exhausted because you’re training through illness or injury. Over-investment in caregiving might mean you haven’t had a conversation about your own interests in months.

The tricky thing about over-investment is that it often feels virtuous in the moment. Our culture celebrates the person who “gives 110%” to their job, the parent who sacrifices everything for their children, the friend who’s always available in a crisis. But portfolios need diversification to remain stable.

When one area demands too much for too long, other areas don’t just stay static—they actually deteriorate. Neglect your relationships long enough, and they require active repair work, not just renewed attention. Ignore your health, and you’ll eventually be forced to invest heavily in recovery.

Defining Your Portfolio Categories

Your life portfolio doesn’t need to match anyone else’s. The categories that matter to you might be completely different from your neighbor’s, and that’s exactly how it should be.

Some people have large allocations toward creativity or learning. Others prioritize community involvement or spiritual practice. Some include adventure or travel as a distinct category, while others fold those into relationships or personal growth.

The key is being intentional about what you’re actually investing in, rather than letting default cultural expectations make the decisions for you. If you value deep friendships but find yourself constantly canceling plans because work ran late, your stated values and your actual allocation don’t match.

Take some time to identify your core categories. What areas of life do you want to remain healthy over the long term? What would you regret neglecting for years? These become your portfolio categories.

The Gentle Art of Rebalancing

Here’s where the portfolio metaphor gets really useful: rebalancing isn’t a daily activity. You don’t check your investment portfolio every morning and panic if one stock is down. You rebalance periodically, making thoughtful adjustments based on longer-term patterns.

The same approach works for life. Instead of daily guilt about what you’re not doing, try a monthly check-in. What has been getting most of your attention? What’s been neglected? What does the next month need to look like?

This might mean saying no to extra projects at work so you can invest more in health. Or it might mean accepting that during your busy season at work, your social life will be lighter, and that’s okay as long as it’s temporary and intentional.

Rebalancing isn’t about perfect balance every day—it’s about conscious choices over time.

The monthly rebalancing ritual removes the daily shame spiral. You’re not failing when you skip the gym for a week because your elderly parent needed extra support. You’re making a conscious, temporary reallocation that you’ll adjust next month.

Some seasons require heavy investment in one area. Starting a business, having a baby, caring for aging parents, recovering from illness—these are times when your portfolio naturally becomes less balanced. The portfolio approach doesn’t judge these seasons; it simply acknowledges them as temporary and plans for eventual rebalancing.

What Success Actually Looks Like

In a portfolio life, success isn’t about peak performance in every category. It’s about long-term sustainability and alignment with your values. It’s about being able to respond to life’s demands without completely abandoning the things that matter to you.

Success might look like maintaining your friendships even when you can’t see friends as often as you’d like. Or keeping up with basic health habits even when you can’t maintain your previous workout routine. It’s about graceful degradation rather than complete abandonment.

The portfolio approach also changes how you think about other people’s choices. When you see a colleague leaving early for their kid’s soccer game, you’re not thinking “they’re not committed to work.” You’re recognizing a conscious allocation choice that probably makes their overall portfolio healthier.

This perspective is especially crucial for working parents, who are constantly managing competing demands. The single-scoreboard approach makes every choice feel like you’re failing somewhere. The portfolio approach recognizes that you’re making strategic allocation decisions based on current needs and long-term values.

Building Systems That Support Rebalancing

The challenge with portfolio thinking is that it requires awareness of where your attention is actually going. Most of us are terrible at tracking our own patterns. We think we’re investing more in relationships than we actually are, or we don’t notice when work has gradually consumed evenings and weekends.

This is where having external support becomes crucial. Whether it’s a partner who helps you notice patterns, a monthly calendar review, or tools that track where your time and mental energy actually go, you need some way to see your portfolio objectively.

The goal isn’t to become obsessively analytical about every choice. It’s to create enough awareness that you can make conscious adjustments before any area becomes completely neglected or over-invested.

The goal isn’t perfect balance—it’s conscious choice.

A system that helps you notice when you’re drifting too far in one direction can prevent the kind of dramatic corrections that feel like starting over. Instead of abandoning your fitness routine entirely during busy periods, you might shift to shorter workouts. Instead of letting friendships go completely dark, you might switch to lower-maintenance ways of staying connected.

The portfolio approach doesn’t eliminate difficult choices or competing priorities. But it does eliminate the shame of being human in a world that demands infinite capacity. Your whole self is more than any single metric can measure. And managing that wholeness with intention and grace? That’s not just success—it’s wisdom.

This article was created with collaboration between humans and AI—we hope you ❤️ it.